The Basic Principles Of Loan Apps

Wiki Article

The Main Principles Of Best Personal Loans

Table of ContentsThe 9-Minute Rule for $100 Loan Instant AppThe smart Trick of $100 Loan Instant App That Nobody is Talking AboutWhat Does $100 Loan Instant App Mean?Things about Loan AppsThe 30-Second Trick For Loan Apps$100 Loan Instant App - Truths

With an individual lending, you pay fixed-amount installments over a set time period up until the financial obligation is totally paid off. Before you apply for a personal car loan, you ought to understand some typical car loan terms, including: This is the amount you obtain. For instance, if you get an individual financing of $10,000, that quantity is the principal.

The 10-Second Trick For Best Personal Loans

APR stands for "yearly portion rate." When you take out any kind of sort of lending, along with the interest, the lending institution will normally bill fees for making the lending. APR includes both your rates of interest and also any type of lender charges to give you a much better photo of the actual price of your funding.

The variety of months you need to repay the finance is called the term. When a lender authorizes your individual lending application, they'll notify you of the interest rate as well as term they're providing. On a monthly basis during the term, you'll owe a month-to-month repayment to the lender. This settlement will include cash toward paying for the principal of the amount you owe, along with a portion of the complete rate of interest you'll owe over the life of the car loan.

With a home or vehicle financing, the genuine building you're getting acts as security to the lending institution. instant cash advance app. A personal car loan is commonly just backed by the good credit standing of the borrower or cosigner. However, some lenders use safeguarded personal car loans, which will certainly require her comment is here collateral, and could offer better rates than an unprotected funding.

The 4-Minute Rule for $100 Loan Instant App

Nonetheless, in the short-term, way too many tough inquiries click here for more info on your record can have an adverse result on your credit rating. If you'll be window shopping by relating to greater than one lender, be sure to do so in a brief time structure to lessen the influence of difficult inquiries.On the plus side, a personal car loan can assist you make a large purchase. Breaking a big expenditure right into smaller sized settlements over time can aid make that price extra workable when you have steady earnings. Individual financings commonly have rate of interest that are less than what you would certainly pay for a bank card purchase.

, as well as mix of credit kinds. best personal loans.

Some Ideas on Instant Cash Advance App You Need To Know

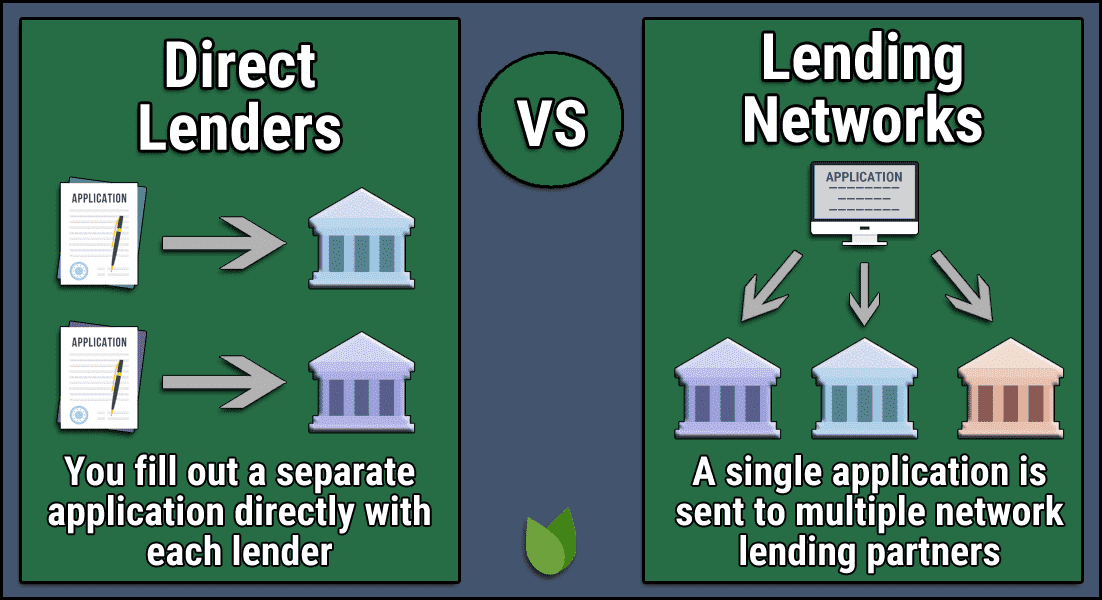

When your company is still young and growing, it is most likely that you will not have adequate funding to feed its growth so that it can recognize its full capacity. Such are the times when you will want to discover your alternatives in terms of finance. Among these options is financial institution loaning.

Before you rush to the local bank, nevertheless, it is necessary that you recognize what the benefits and drawbacks of a small business loan are. Large purchases, specifically those of properties important to your business, will ultimately be required at some time or other. A small business loan can aid in such instances.

Loan Apps Can Be Fun For Anyone

Banks supply an company website enormous benefit below because, without them, it would not be easy for many individuals to start organizations or grow them. For some, it would certainly be downright difficult. Normally, when you take a lending from a financial institution, the financial institution does not tell you what you're going to perform with that cash.These will certainly be various from one bank to the next and are generally flexible, enabling you to opt for the terms that prefer you one of the most. With the ability to shop about from one financial institution to one more and also to discuss for better terms, it's extremely simple to get a sweet handle a bank lending.

If you secure a long-term car loan from a financial institution and make all of your repayments on time, your credit report will certainly enhance over the life of the lending. In instance you finish paying off the whole car loan on time with no missed out on payments, your credit report rating will actually enhance.

Our Instant Cash Advance App Diaries

Depending on exactly how the agreement is attracted up, you risk the bank seizing on your business in the occasion that you are incapable to pay back the loan. Many organization car loans are secured, which implies something is backing the financing. Maybe collateral or an assurance. If the funding is secured by security, after that the bank can assert some asset of yours or your business in case you can not settle the car loan.Report this wiki page